We need clean energy to recharge our economies!

Here’s the problem with crises like the pandemic: they knock your eye off the ball.

While we are all distracted by dilemmas on the personal, micro-scale – staying safe, wearing a mask, keeping a job, coordinating home schooling, and so on – problems at the macro-level can easily become lost in the fog . . . and then forgotten.

The accelerating threat of climate change is one such attention-conflict.

Against such a dramatic recent backdrop, the climate crisis risks suffering a dangerous relegation from a position of ‘too big to ignore’ to ‘we’re too busy to tackle this.’

On an individual level, we understandably prioritize our own, and our family’s, day-to-day health and financial wellbeing, more often than not, at the expense of all else.

On a governmental level, meanwhile, all efforts inevitably swing to trying to control the pandemic and mitigate the devastating impact on the economy and society.

In this new and unwelcome reality, climate change (despite its contributing role in the COVID-19 pandemic) can easily find itself pushed down the priority agenda – even as the ‘opportunity window’ to save the environment shrinks, ever smaller and shorter.

At time of writing, coronavirus has infected more than 73 million people and contributed to the deaths of more than 1.6 million[1]. The cost to the global economy is estimated at up to US$ 1 trillion[2]. This sounds – and indeed is – shocking. But climate change has the power to do even greater harm, displacing hundreds of millions of people worldwide, rendering large swathes of the globe uninhabitable, driving mass migration and even conflict, and costing multiple trillions of dollars to rectify.[3]

Even as the pandemic unfolds around us, dire climate statistics continue to accumulate.

The highest temperature ever recorded on Earth, 54.4oC, was reached in Death Valley, California, in mid-August 2020[4].

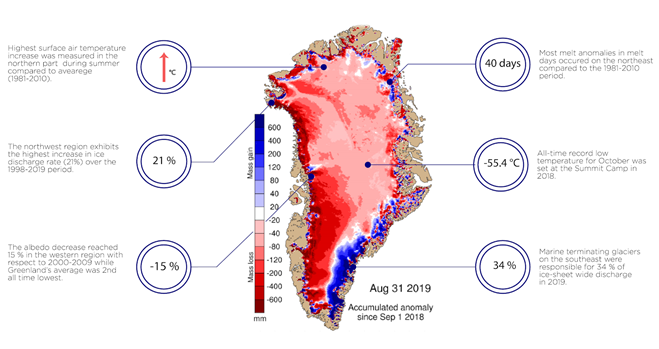

Simultaneously, scientists warn us that Greenland ice sheets lost a record one million tons of ice per minute in 2019[5], contributing to a 28 trillion-ton ice deficit over the last 30 years[6].

How, then, do we keep attentions focused on the longer-term perils of climate change, and encourage governments to reboot their economies with environmentally friendly sustainable strategies?

Renewable energy weathers fallout from pandemic

Countries around the world are mulling enormous commercial stimulus packages to reignite economies brought to their knees by the impact of the pandemic – packages estimated to be worth as much as US$ 9 trillion[7].

The record-low interest rates have created an attractive financial basis for investing in green infrastructure. In the United States, President-elect Joe Biden has outlined plans for a US$ 2 trillion decarbonization plan for the country’s gas-guzzling economy. The EU has earmarked 30% of its US$ 880 billion COVID-19 recovery plan for climate measures, and in her state-of-the-union address in September, Ursula von der Leyen, the president of the European Commission, confirmed the EU’s aim to cut greenhouse-gas emissions by 55% over 1990 levels in the next decade[8].

This once-in-a-lifetime scenario presents us with an unprecedented opportunity to change course.

An opportunity that will dictate the energy trajectory for the coming generation, with the power to either supercharge, or undermine, the fledgling clean energy transition.

Most people with an emotional interest in the planet’s future would prefer the former, but several red flags already loom on the horizon.

While acknowledging that some of these issues are likely to be temporary, global consultancy Ernst & Young highlights several challenges coronavirus has triggered for the renewable energy market.

- Some projects currently under construction are struggling to source equipment

- Operation and Maintenance (O&M) teams are harder to move around due to travel restrictions

- Lower power prices are likely to squeeze project margins

- And plunging oil prices threaten the ability of oil and gas companies to continue investing in sustainable energy technologies.[9]

A report by the International Energy Agency (IEA) recognizes the commercial cost of COVID-19’s impact: a global economy set to contract by 6% this year, with some 300 million job losses in the second quarter, and energy investments plunging by as much as one-fifth[10].

None of these hurdles should divert us from the overwhelming urgency of tackling climate change – nor the unexpected opportunities presented by the reset button of the pandemic.

In such turbulent times, how do we prevent ourselves, as the former head of the UN Framework Convention on Climate Change, Christiana Figueres, says, “jumping out of the frying pan of the pandemic and into the fire of exacerbated climate change”?[11]

Simple solutions to sustainable recovery

To win both government support and public opinion requires a delicate balancing act: awareness of the present coupled with respect for the future.

Put simply, what sort of steps can policymakers adopt that will bring both short and long-term benefits to both the environment and the economy?

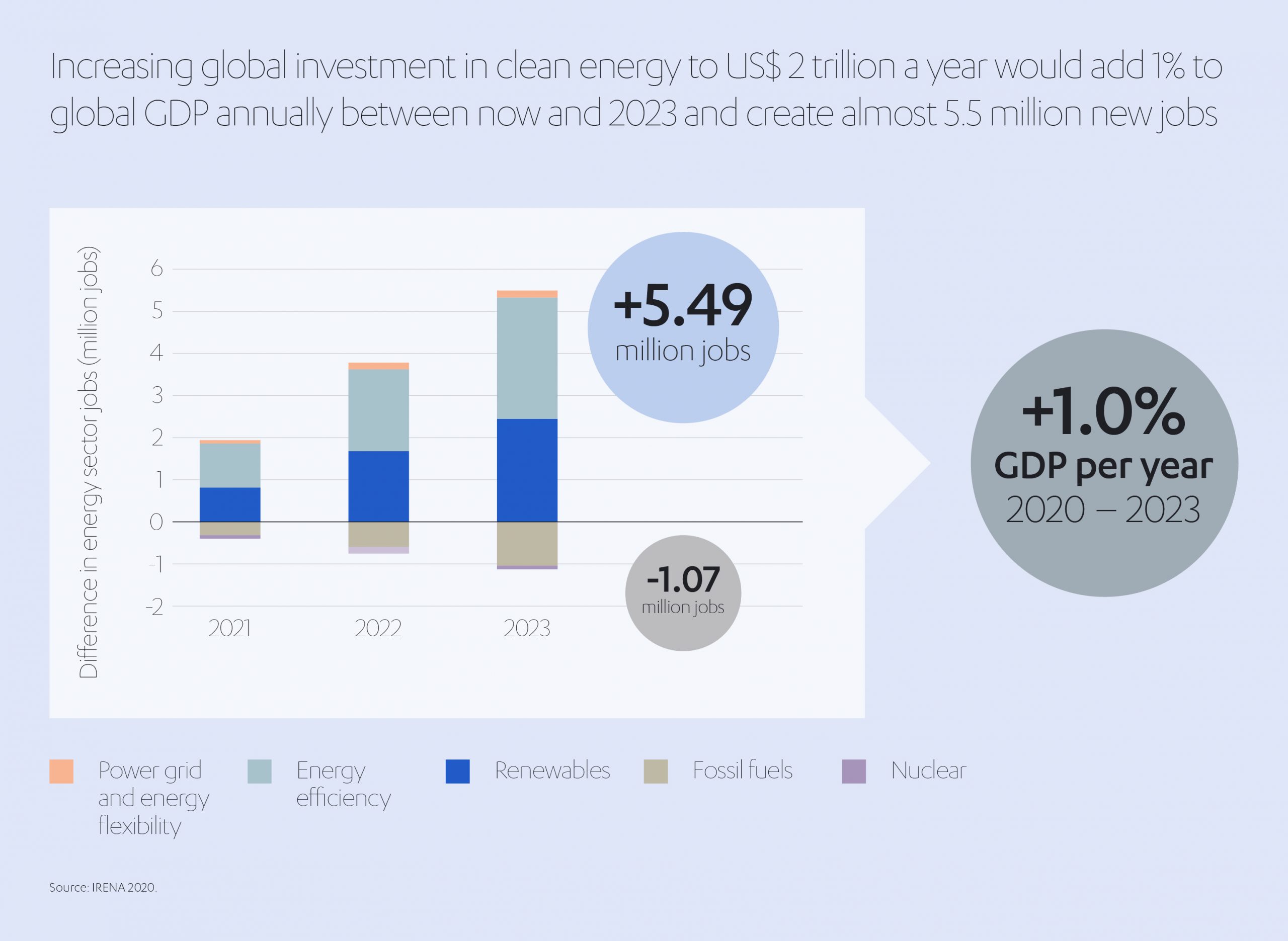

First – think jobs. Government support for green power schemes such as solar and wind farms are tipped to trigger an avalanche of much-needed work opportunities.[12]

The International Renewable Energy Agency (IRENA) argues that scaling-up worldwide investment in clean energy to US$ 2 trillion a year would add 1% to global GDP annually between now and 2023 and create almost 5.5 million new jobs; increasing that figure to US$ 4.5 trillion a year would see a cumulative GDP gain of US$ 16 trillion between now and 2030 and create more than 15 million new jobs.[13]

FRV, a leading global developer of renewable utility-scale projects and part of Abdul Latif Jameel Energy, exemplifies the ambition, commitment and innovation that is necessary to truly achieve the potential of the global renewable energy sector.

FRV, a leading global developer of renewable utility-scale projects and part of Abdul Latif Jameel Energy, exemplifies the ambition, commitment and innovation that is necessary to truly achieve the potential of the global renewable energy sector.

With a presence on five continents; and a track record of over fifty plants developed; a project portfolio of over 2.5 GW in emerging solar markets including Australia, the Middle East, India, Africa, USA and Latin America; and over US$ 3 billion in total financing managed with more than 20 leading banks, over more than a decade, FRV has established itself as a committed investor in our planet’s sustainable future, and a provider of sold, long-term employment opportunities.

But what else? Well, with consumer spending low, governments could use trade-in scrappage schemes to motivate people to replace aged, emissions-heavy items such cars and washing machines with newer, cleaner models.

Why stop there? Prompted by the sharp rise in home schooling and remote working during the pandemic, governments could take the opportunity to refocus attentions on affordable, dependable electricity supplies. Spending now to strengthen power grids will prepare them for the technologies of the future, and for the integration of a greater share of wind and solar energy in years to come.

And while we’re thinking in cutting-edge terms, what better time to pave the way for battery, hydrogen cell and carbon capture technologies? Pumping timely funds into these fast-moving areas will make them much more cost-competitive, to say nothing of creating near-limitless job streams.

Battery technology is already experiencing sharp cost declines, with car battery packs falling from US$ 1,100/kWh in 2010 to US$ 160/kWh in 2019,[14] and can be the catalytic ‘missing-link’ to making wind and solar viable complete alternatives for fossil fuel generated power by offering 24/7 clean solution.

The FRV/Harmony Energy project at Holes Bay, Dorset, in the UK is case in point. The project uses six Tesla Megapack, lithium-ion batteries that enable utility-scale energy storage. The Megapack batteries have a capacity of 15 MWh and are connected to the local power distribution network, providing the capability to store energy from renewable sources and afford peak-time flexibility to the UK National Grid as part of the UK’s continuing shift away from fossil fuels.

Few of these strategies will come without a price, however, so the final part of the puzzle will probably involve attracting more private investment, as at Holes Bay.

Policies supportive of green energy projects (loans, carbon pricing, public-private partnerships) will all give potential investors the confidence they need to take that next step and make environmentally friendly energy the cornerstone of our global coronavirus recovery.

Parallel payoffs: environment and economy

Lead Economist, Climate Change Group, World Bank

One voice worth paying close attention to is Stéphane Hallegate, World Bank climate change economist.

Hallegate advocates seizing the moment to provide financial backing for other kinds of environmental investments.

Think preserving and restoring ecosystems prone to floods, drought and hurricanes. Think cleaning-up polluted lands. Think encouraging more sustainable transport infrastructure such as metro systems.

Hallegate is in little doubt:

“If we are strategic in how we design policy responses, we can achieve both short and long-term outcomes that benefit both national and global interests.”[15]

The IEA concurs with this blueprint, and in its 30-step Sustainable Recovery Plan outlines several further strategies encompassing six key sectors: electricity, transport, industry, buildings, fuels and emerging low-carbon technologies. The outcomes are the sort that would appeal to any rational government – continued economic growth, future-proofed jobs and sustainable development.[16]

These additional IEA recommendations include:

- Increasing investment in hydro and nuclear power to help maintain output, since facilities and equipment in advanced markets are frequently approaching the end of their useful lives

- Boosting wind and solar PV to capitalize on their trajectories as the only energy sources to grow in 2020

- Supporting automotive industries via improved financing or tax reductions for low-emission vehicles

- Expanding high-speed rail networks, which on average require 12-times less energy per passenger kilometer than airplanes and road vehicles

- Improving urban infrastructure to exploit the rise in walking and cycling during the pandemic

- Retrofitting existing buildings for energy efficiency, estimated to generate up to 30 jobs per million dollars invested

- Promoting further recycling of waste and materials

- Supporting the use of biofuels, stemming the estimated 15% production decline in 2020.

The compensations are enticing. If adopted, the IEA’s recommendations could reduce greenhouse gas emissions by 4.5 billion tons and air pollution by 5% between now and 2023 – all while creating or saving approximately 9 million jobs.[17]

IEA executive director Dr Fatih Birol says governments have “a once-in-a-lifetime opportunity to reboot their economies and bring a wave of new employment opportunities while accelerating the shift to a more resilient and cleaner energy future”.

The opportunities are clear. The dangers of burying our collective heads in the sand are even starker.

Danger of derailment?

As the battle against the coronavirus crisis continues, we can already see a great divergence in government responses worldwide.

Despite glimmers of hope in some countries, other territories, intentionally or otherwise, are experiencing environmental setbacks during this crucial recovery phase.

China, for instance, in an effort to slash the cost of its renewable energy subsidy scheme, has surrendered its previous pole position on Ernst & Young’s global Renewable Energy Country Attractiveness Index (RECAI).[18] The Chinese government has been lowering its subsidies for onshore wind and solar projects to offset the US$ 14 billion deficit of its Renewable Energy Development Fund. It has budgeted just US$ 700 million for new renewables in 2020.

Without extra support, it is feared that China’s onshore power additions could grow by less than 0.5 GW per year for the remainder of the decade.[19]

Elsewhere, India’s progress in renewables has slowed amid warnings it could miss its 175 GW target for 2022, a trend only likely to be exacerbated by COVID-19. As for Japan, it has weathered some disappointing solar auctions in 2020, with allocated capacity falling short of availability. Solar growth rates are expected to fall from 10% in 2019 to 5% for the remainder of the decade, while Egypt has been battling low industrial power price predictions, with its solar PV forecast reduced by 0.6 GW over the next five years.

Similarly, in South America, Chile is sounding a similarly downbeat note by postponing its planned 2020 electricity auction, citing falling GDP and a 6% drop in power demand.

And yet, before we despair too much, the outlook in other markets suggests coronavirus represents a blip rather than a terminal blow to the clean energy transition.

Milestone projects offer cause for hope

In a promising development, the United States has claimed top place on RECAI for the first time since 2016. This is credited to an extension of its Production Tax Credits (PTC) scheme. Long-term growth has been recorded in the USA’s offshore wind market, and there are plans for US$ 57 billion investment to install a further 30 GW by the end of the decade.[20]

Signs are also hopeful in Europe.

In France, 1.4 GW of wind and solar energy has been awarded in its most recent tender, with plans for a further 28 GW of wind and solar projects over the next five years. Across the border in Italy, 500 MW of contracts have been allocated in its latest renewable auction, and plans are in the pipeline for six more rounds of auctions totaling 4.2 GW under CFDs (‘contracts for difference’ – a mechanism for removing all exposure to market risk). In Greece, meanwhile, the government is phasing out the use of lignite coal, decommissioning some 4 GW of coal-fired capacity by 2023.[21]

Similarly, Spain’s national energy and climate plan, submitted to the European Commission in April 2020, sets a target of a 23% cut in emissions by 2030, compared with 1990 levels. The plan anticipates an increase in wind power from 28GW in 2020, to 50 GW by 2030, and a growth in solar photovoltaics (PV), from 8.4 GW at the start of 2020, to 39 GW in 2030.

I’m proud that FRV is making its own contribution to achieving these objectives here, too. In September 2020, FRV achieved financial close on the 138 MW San Serván photovoltaic plant in Extremadura, Spain, set to power some 105,000 Spanish homes.

The project is the first Climate Bond Certified green transaction in Spain, with a €64 million ‘green loan’. The project is not only significant as a step towards Spain decarbonizing its energy sector, it also demonstrates FRVs commitment to sustainable best practice in solar finances.

Saudi Arabia, meanwhile, is reaffirming its focus on renewable energy with plans to generate 25 GW of green energy in the next five years, increasing to 60 GW over the coming decade. Two-thirds of this energy will be derived from solar power, exploiting the relentlessly hot and sunny climate of the Middle East.

As ever, the vision of a low-pollution energy future will live or die by economic realities. As forward-thinking nations begin to reap rewards from green-infused recovery strategies, there is every reason to believe that momentum will swing behind sustainable investments from the private sector, too.

Sustainable investment: a niche no more

It’s pleasing to see that investors with an eye on ethics and changing public priorities are increasingly looking beyond black-and-white financials when deciding where to direct their assets. The rise of environmental, social and governance (ESG) investing demonstrates how investors are beginning to align their goals with issues such as climate change and social inequality.

And it’s big business.

The Financial Times expects ESG funds to grow threefold by 2025, their share of the European fund sector soaring from 15% to 57%, with sustainable investment products across the continent tipped to hit €7.6tn over the next five years.[22]

These changing habits will have widespread reverberations. Not only will they organically redirect capital into sustainable activities (the technology sector is a magnet for ESG investment, industrials far less so) but it will also force businesses to be more transparent about their environmental impact.

ESG has so far shown immunity against even that most rapacious of villains – COVID-19. 2020 has seen record levels of ESG investment worldwide despite market turmoil triggered by the pandemic.[23] A coincidence? Hardly.

Goldman Sachs has noted that “prior to this crisis there was a meaningful and increasing focus on ESG investing, and it is likely that this focus will only increase following coronavirus.” [24]

In a survey by KPMG, more than one-third of senior company executives admitted investor pressure was increasing their focus on ESG[25]. A poll by Morgan Stanley, meanwhile, indicated 80% of asset owners are already incorporating ESG factors into their investment choices.[26]

Nor is it only about changing institutional investing patterns. Private businesses – like Abdul Latif Jameel – can help to catalyze both business and government investment into solutions to combat climate change and accelerate a green recovery. Organizations like the Clean, Renewable and Environmental Opportunities Syndicate (CREO Syndicate), are already helping to change attitudes and explore private investment opportunities across the global ESG marketplace.

As the CREO explains in a white paper, “Overall interest in sustainable investing is growing as many institutional investors and wealth owners re-evaluate their exposure to fossil fuels and as political discourse on climate risks builds. Wealth owners are at the forefront of the trend, driven by a long-term time horizon that is a natural match to sustainable investments, personal values, and interests expressed by next-generation members.”[27]

I believe this powerful combination of factors can play a central role as we seek to be build a greener recovery.

Sustainable stimulus plans bring us back from the brink

The pandemic has undoubtedly brought us to a unique crossroads in time: a cultural and economic divergence which will dictate the kind of world in which we live for decades to come. It affords us the opportunity to address, at last, problems which had been gestating for a long time – problems which if ignored may eventually become too ingrained to solve.

It has been estimated that weather-related disasters cost the US economy US$ 309 billion in 2017 alone[28] and that losses from climate disasters globally have hit US$ 3 trillion over the past decade.[29]

Former UN climate change head Christiana Figueres warns that if by 2030 we have not halved greenhouse gas emissions “we will not be able to avoid devastating tipping points that would shatter the global economy and pose existential human threats. The costs of inaction are staggering — US$ 600 trillion by the end of the century.”[30]

We should all heed those words – existential human threat. In such context it is easy to envisage nations which fail to act in the global interest becoming pariahs on the international scene.

It is the tendency of governments to react rather than plan, to think only of the next few years until voters return to the ballot boxes. Yet, with the solutions to our dual dilemmas (the post-pandemic economic recovery and the clean energy transition) so harmoniously intertwined, surely now is the time to adopt a truly different mindset: long-term thinking for long-term rewards.

Post-pandemic economic stimulus and investment with environmental priorities are the only ways to guarantee we can pass on to future generations a world worth saving.

[1] https://coronavirus.jhu.edu/map.html

[2] https://www.weforum.org/agenda/2020/03/coronavirus-covid-19-cost-economy-2020-un-trade-economics-pandemic/

[3] https://www.bloomberg.com/news/articles/2019-09-09/the-massive-cost-of-not-adapting-to-climate-change

[4] https://amp.theguardian.com/environment/2020/aug/19/highest-recorded-temperature-ever-death-valley

[5] https://www.theguardian.com/environment/2020/aug/20/greenland-ice-sheet-lost-a-record-1m-tonnes-of-ice-per-minute-in-2019

[6] https://www.theguardian.com/environment/2020/aug/23/earth-lost-28-trillion-tonnes-ice-30-years-global-warming?utm_term=f5e7d6a02f5e35528cad68d5646a9138&utm_campaign=GuardianTodayUK&utm_source=esp&utm_medium=Email&CMP=GTUK_email

[7] https://www.iea.org/reports/sustainable-recovery

[8] The Economist, September 2020.

[9] https://www.ey.com/en_gl/power-utilities/in-the-wake-of-a-human-crisis-do-climate-goals-take-a-back-seat

[10] https://www.iea.org/reports/sustainable-recovery

[11] https://www.ft.com/content/9e832c8a-8961-11ea-a109-483c62d17528

[12] https://www.iea.org/commentaries/how-to-make-the-economic-recovery-from-coronavirus-an-environmentally-sustainable-one

[13] https://mailchi.mp/adfd6e581840/irena-outlines-agenda-for-sustainable-economic-recovery-332306?e=63a2dbe8b3

[14] https://www.iea.org/reports/sustainable-recovery/strategic-opportunities-in-technology-innovation#abstract

[15] https://www.preventionweb.net/news/view/71103

[16] https://www.iea.org/reports/sustainable-recovery

[17] https://www.iea.org/reports/sustainable-recovery

[18] https://www.ey.com/en_us/recai

[19] https://www.ey.com/en_gl/power-utilities/in-the-wake-of-a-human-crisis-do-climate-goals-take-a-back-seat

[20] https://www.ey.com/en_us/recai

[21] https://www.ey.com/en_gl/power-utilities/in-the-wake-of-a-human-crisis-do-climate-goals-take-a-back-seat

[22] https://www.ft.com/content/5cd6e923-81e0-4557-8cff-a02fb5e01d42

[23] https://www.cnbc.com/2020/06/07/sustainable-investing-is-set-to-surge-in-the-wake-of-the-coronavirus-pandemic.html

[24] https://www.cnbc.com/2020/06/07/sustainable-investing-is-set-to-surge-in-the-wake-of-the-coronavirus-pandemic.html

[25] https://assets.kpmg/content/dam/kpmg/be/pdf/2018/05/esg-risk-and-return.pdf

[26] https://www.morganstanley.com/press-releases/morgan-stanley-sustainable-signals–asset-owners-see-sustainabil

[27] https://creosyndicate.org/news-collection/pathwaystoinvesting

[28] https://www.morganstanley.com/im/publication/insights/investment-insights/ii_weatheringthestorm_us.pdf

[29] https://www.reuters.com/article/us-climate-disaster-losses/last-decade-most-expensive-for-natural-disasters-report-idUSKBN1ZL00H

[30] https://www.ft.com/content/9e832c8a-8961-11ea-a109-483c62d17528

1x

1x

Added to press kit

Added to press kit