Shuqaiq 3: investing in the future

The Shuqaiq 3 desalination plant in Jizan province in south-west Saudi Arabia will be one of the largest reverse osmosis (RO) desalination plants in the world when complete in the fourth quarter of 2021. Awarded to a consortium of Almar Water Solutions (through Abdul Latif Jameel Enterprises), Acciona, Marubeni Corporation and Rawafid Alhadarah Holding Co, the 450,000 cubic meter daily production capacity from this US$ 600m infrastructure investment will guarantee the supply of drinking water to over 1.8 million citizens, while also contributing to economic and industrial development both locally and nationally.

Recognized throughout the water industry as one of the most complex and innovative plants of its kind, in September 2019 it was named the “Utilities Project of the Year” at the Middle East Energy Awards 2019, held in Dubai, UAE, cementing its status as one of the flagship new infrastructure projects in the region.

In our latest feature article on the landmark project, we spoke to Santiago Martínez, Managing Director, Concessions at Almar Water Solutions and board member of the SPV managing the project, to discuss why water structure investment is such a vital issue, and how Shuqaiq 3 fits into this picture.

Managing Director, Concessions

Almar Water Solutions

How will Shuqaiq 3 contribute to the economic development of this region of Saudi Arabia?

SM: The Shuqaiq 3 seawater desalination plant is being developed to provide water to the provinces of Jizan and Asir in south-west Saudi Arabia, with a population of around 4 million people. These regions, very close to the border with Yemen, are extremely dry and have historically suffered from a chronic deficit of freshwater resources.

Water was traditionally supplied from groundwater resources and thermal desalination plants. However, the economic expansion of the area, combined with a growing population, mean that water demand is increasing. The existing water resources are not enough to cope with this rising demand.

Shuqaiq 3 is the first large scale desalination plant in the southern region of Saudi Arabia to use pure reverse osmosis technology, together with high power efficiency. It will supply more than 150 gigalitres per year of drinking water to meet the demands of the region’s communities and industries, while preserving groundwater reserves for future generations.

What advantages will it bring to both the population and to the industrial sector?

SM: Shuqaiq 3 will provide cities and industries in the region with a substantial increase in the availability of drinking water sources and improved water quality. The plant is incredibly efficient and will be able to supply water 24/7, at a very competitive price.

The additional water resource it provides will facilitate a proper development of local cities and industrial centers, as well as supplying new agricultural developments with modern irrigation technologies and systems.

What is Abdul Latif Jameel Energy’s role in this project?

SM: Abdul Latif Jameel owns a substantial stake in the project company and has co-led the consortium through Almar Water Solutions team in the development phase (tendering and financial close).

Since construction began in Q2 2019, Abdul Latif Jameel Energy’s main role has been in connection with technical matters (engineering, project management and supervision of the EPC contractor), as well as helping to steer the project company in terms of proper management and governance.

Despite the challenges of the COVID-19 crisis, Shuqaiq 3 remains on schedule. How did you achieve this?

SM: Project progress is over 90% completion and we are working at full speed to achieve our operational go-live date as scheduled by the end of October 2021.

The COVID-19 pandemic certainly added an extra challenge in terms of project management. It has been necessary to implement the required prevention measures (such as social distancing, curfews, travel restrictions, etc). We also implemented acceleration plans regarding equipment supplies, logistics and subcontractors, to achieve our target productivity and hit key milestones.

Safety has been a priority throughout, and we are delighted to have achieved over 8.3 million man-hours so far at the desalination plant and a further 1.3 million at the substation, both with zero lost time injuries. I’m very proud of all the efforts made by our project company, the EPC contractor, and the client to overcome all the difficulties we have found along the way.

Do you think infrastructure is a safe investment asset?

SM: Investing in infrastructure in general is a crucial factor for the growth and socio-economic development of any country.

Good infrastructure (such as roads, electricity, water, sanitation, communications, etc) is not only essential for industrial production or to supply basic services to citizens, but it is also an engine for development. It helps to increase productivity, reduce costs, facilitate the accumulation of human capital (allowing greater access to education, health or housing, for example), helping to diversify the productive structure and create employment.

This is why many international organizations and NGOs consider that improving infrastructure is vital to reduce poverty and increase growth.

What about investing in water infrastructure?

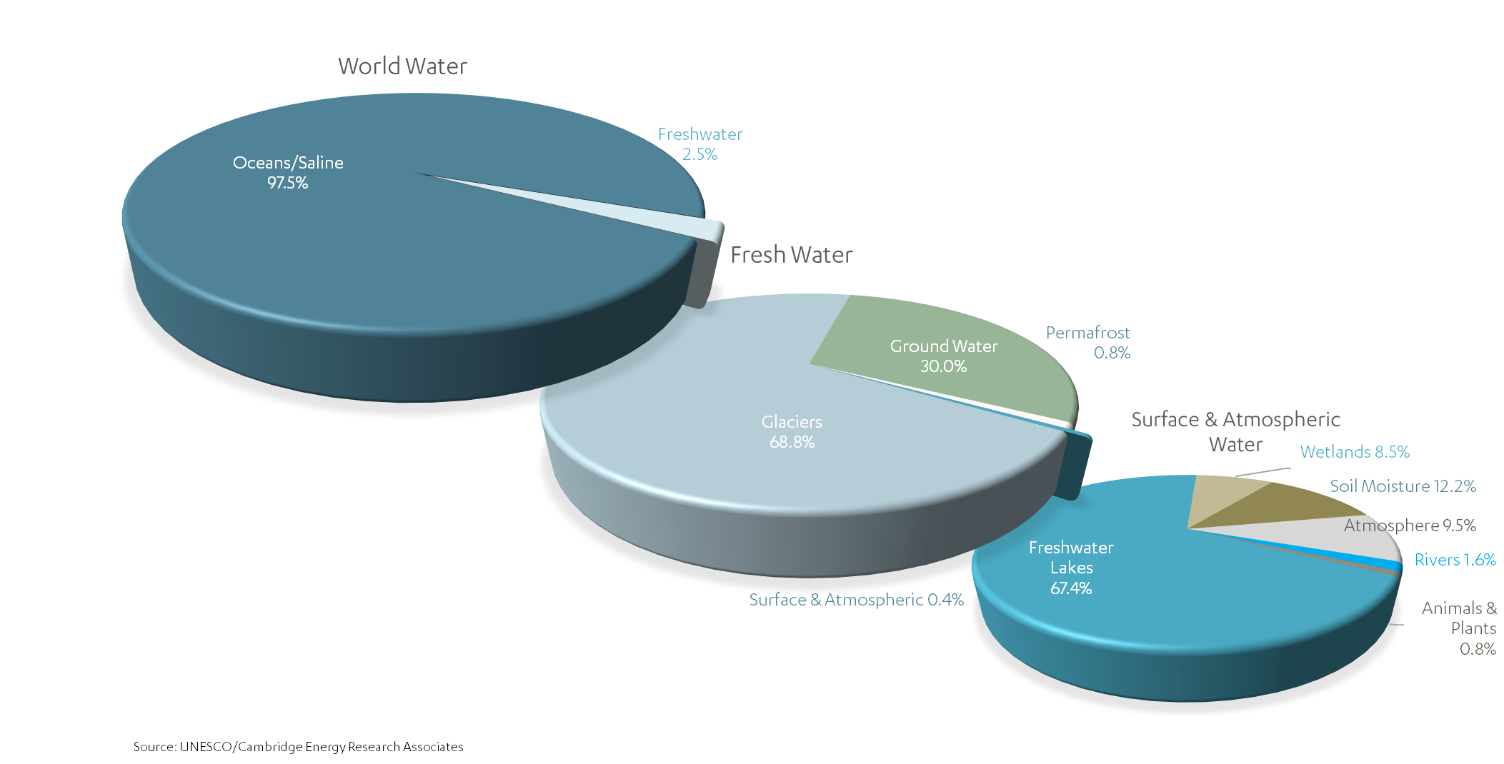

SM: In terms of water infrastructure investment in particular, water is a vital natural resource; one that is not quite so abundant as people might think, and which unlike other commodities, has no substitute.

The Earth’s available fresh water is estimated to be just 0.7% of all the water in the world. Generally found in rivers, lakes, and aquifers, it is often not easily accessible and is increasingly threatened by climate change and contamination.

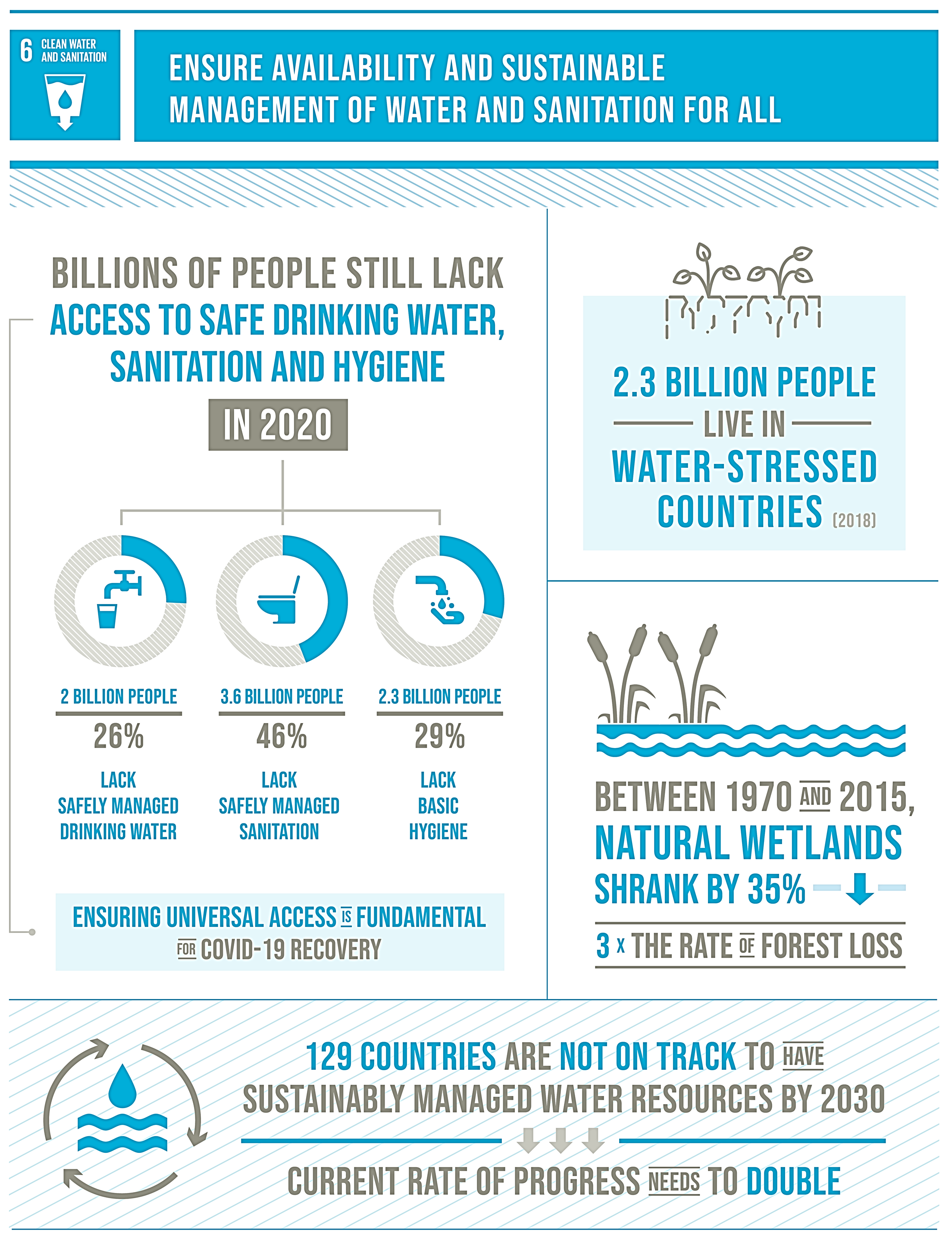

According to the UN, by 2025 an estimated 1.8 billion people will live in areas suffering from water scarcity, with two-thirds of the world’s population living in water-stressed regions.

On top of this, there is a chronic lack of infrastructure to cover the existing population’s water needs. The UN estimates that 10% of the global population (c. 800 million people) has no access to safe drinking water and one-third (c. 2.5 billion) are without access to basic sanitation.

What is the role of the private sector in developing solutions to these challenges?

What is the role of the private sector in developing solutions to these challenges?

SM: The current situation of water scarcity and sanitation presents an enormous economic and social challenge: to provide a secure supply of usable water to the billions of people and countless businesses that depend on it every day.

Achieving this requires huge investment on a scale that governments and the public sector alone cannot provide.

Public sector funding is already under substantial financial pressure, a situation made much worse by the COVID-19 pandemic, so the private sector will very likely need to play a greater role in funding water investments.

This is why private sector water businesses like Almar Water Solutions have such a vital role to play in investing in water infrastructure to help address these challenges.

How safe are investments in water infrastructure?

SM: Water is a compelling business model. Due to global population growth, demand for clean, fresh water continues to increase – unaffected by economic conditions, political developments, or ever-changing consumer preferences. The sector is seen by many as a long-term investment opportunity that has historically offered stable, consistent returns and can serve as an alternative to low-yielding bonds and volatile equity markets.

In the case of specific structured project finance contracts (PPP) like Shuqaiq 3, with a long-term contract backed by the Government, the asset is classified as a financial asset. This means the return is known and fixed during the whole contract life from the very start of construction.

What are the advantages of investing in water projects?

SM: Water investing has the potential to offer strong, long-term, consistent growth potential in a wide range of market or economic environments.

Given the scale of the global water problem and the fact that water infrastructure is extremely costly and capital intensive, it is not surprising that water is increasingly viewed as a core commodity that is potentially as profitable as oil, metals or agriculture, for example.

It is not inconceivable to imagine a situation where water as an asset class could eventually become the single most important physical commodity-based asset class. Water assets are already being traded on the US stock exchange since October 2020.

In the next three to five years, the private sector is expected to account for 30% of water investments. Europe has already started to make the transition to private sector provision. The majority of water services in the UK and France, for example, are handled by private operators. This trend is likely to continue globally, which will have significant implications for the investment landscape.

1x

1x

Added to press kit

Added to press kit