Powering potential: renewable energy in Latin America

Latin America grabbed headlines at the United Nations Climate Action Summit in New York in November 2019, when it pledged a collective target of 70% renewable energy use by 2030 – more than double the EU’s target of 32%[1].

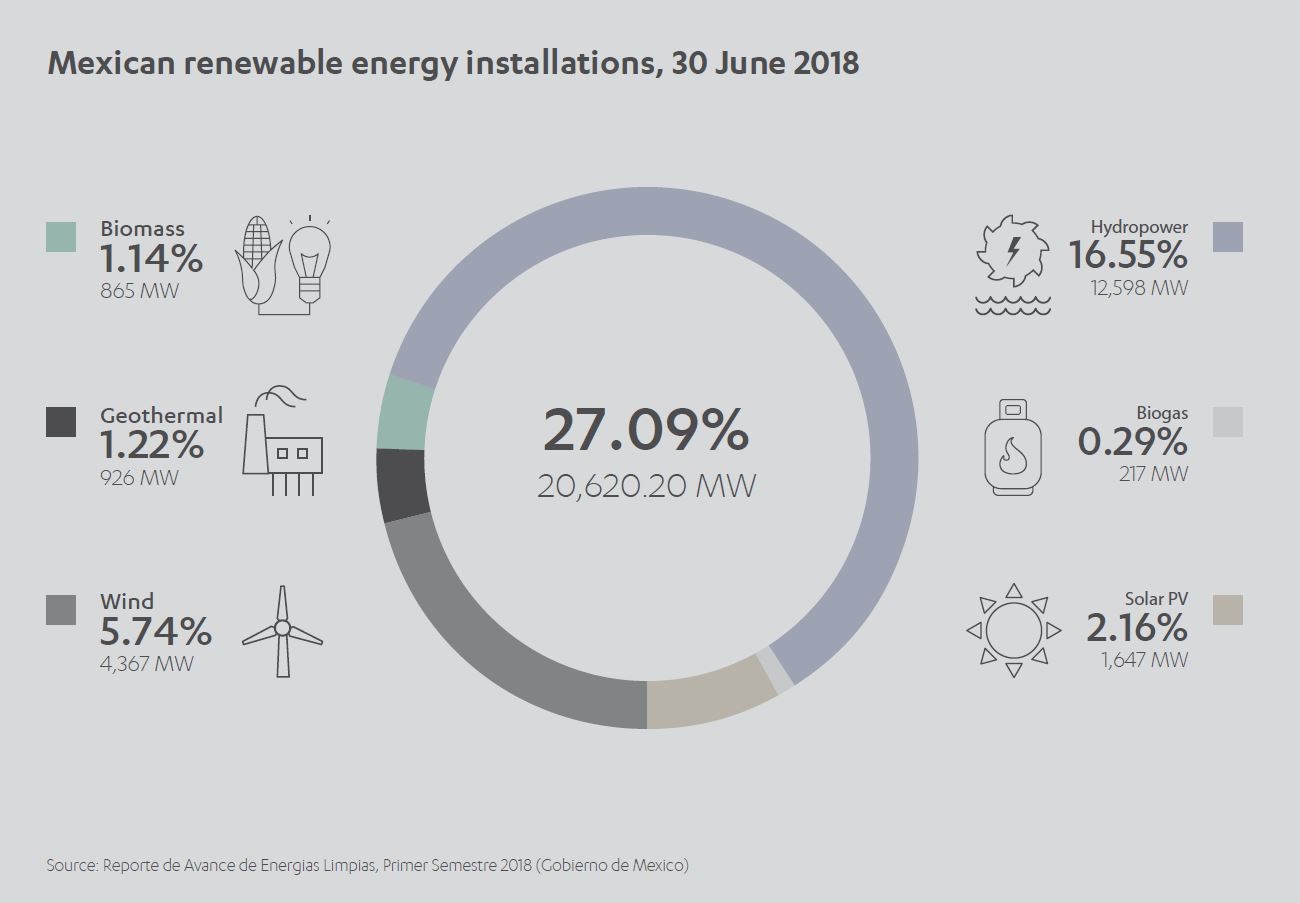

According to a report from ABN Amro[2], in 2018 renewables accounted for around 25% of the energy supply. So, achieving this target will require substantial investment in a diverse range of renewable energy technologies.

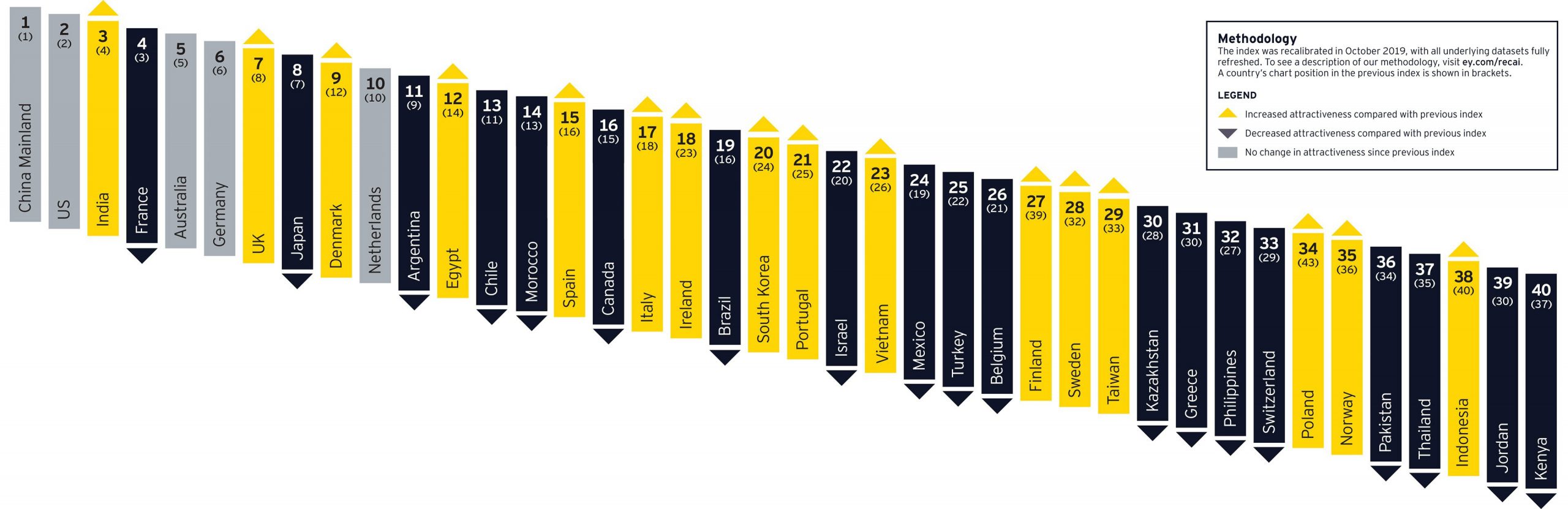

There should be no shortage of potential investors. Latin American countries represent four of the top 20 most attractive renewable energy markets in the world[3], with a great number of opportunities in both greenfield projects and the secondary market according to EY’s ‘RECAI’ index.

Between 2012 and 2015, renewables investments in Latin America totaled around US$ 54 billion[1], mostly in Brazil, Chile and Mexico. In 2017, alone, investment in renewable energy across the region jumped 65% to US$ 17.2 billion, compared to a global average of just 3% growth[2]. The rise was driven by record investment in Mexico and a nine-fold increase in Argentina, particularly in wind and solar sectors. Other major investment destinations in the region included Brazil, Peru, Chile and Costa Rica.

Coping with climate change

Maintaining the exponential level of growth in renewable energy in Latin America not only makes compelling economic and commercial sense, it is also an environmental necessity.

Latin America has made a relatively small contribution to climate change in historical terms – its carbon emissions made up only around 7% of the global total in 2015[3] – yet it is likely to suffer disproportionately from the negative impacts.

Temperatures in parts of Latin America and the Caribbean are expected to rise between 2°C and 3°C by 2050, and between 2.5°C and 4.5°C by 2100[4]. The resulting deterioration of ecosystems, extreme weather events and loss of biodiversity will have major implications for economies and social well-being.

Indeed, the region’s geography, climate, topography and demographics, together with the climate-sensitivity of natural assets mean that climate change is already a daily reality for many.

Its long coastlines and many low-lying islands make it uniquely vulnerable to rising sea levels. For example, while the inexorable rise of global temperatures has begun to accelerate the melt rate of vast glaciers in Chile and Argentina, this has increased the danger of catastrophic floods.

Latin America is home to vital environmental assets such as the Amazon rainforest, Brazil’s Pantanal and Colombia’s Páramos – globally significant natural wonderlands of immense biodiversity. Minor changes to the delicate ecological balance of these areas have the potential to cause exponentially larger knock-on effects around the world.

South and Central America are already accustomed to extreme weather phenomena. Dorian, the hurricane that devastated the Bahamas in September 2019, had sustained winds of 185mph, while the most recent El Niño event, which ended in 2016, caused severe droughts throughout the region.

The socio-economic situation in many Latin American and Caribbean countries also makes them disproportionately vulnerable to the effects of climate change. According to a report from the UN’s Economic Commission for Latin America and the Caribbean, 30.1% of the region’s population lived below the poverty line in 2018, while 10.7% lived in what the Commission describes as “extreme poverty”[5]. This means that approximately 185 million people were below the poverty threshold in 2018, with 66 million of these people experiencing extreme poverty.

Chile leading the charge

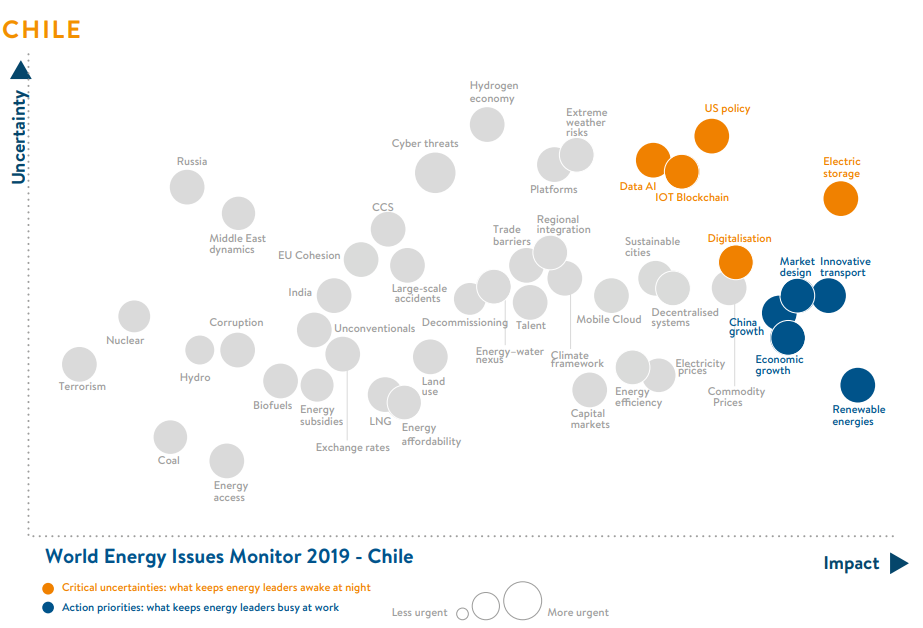

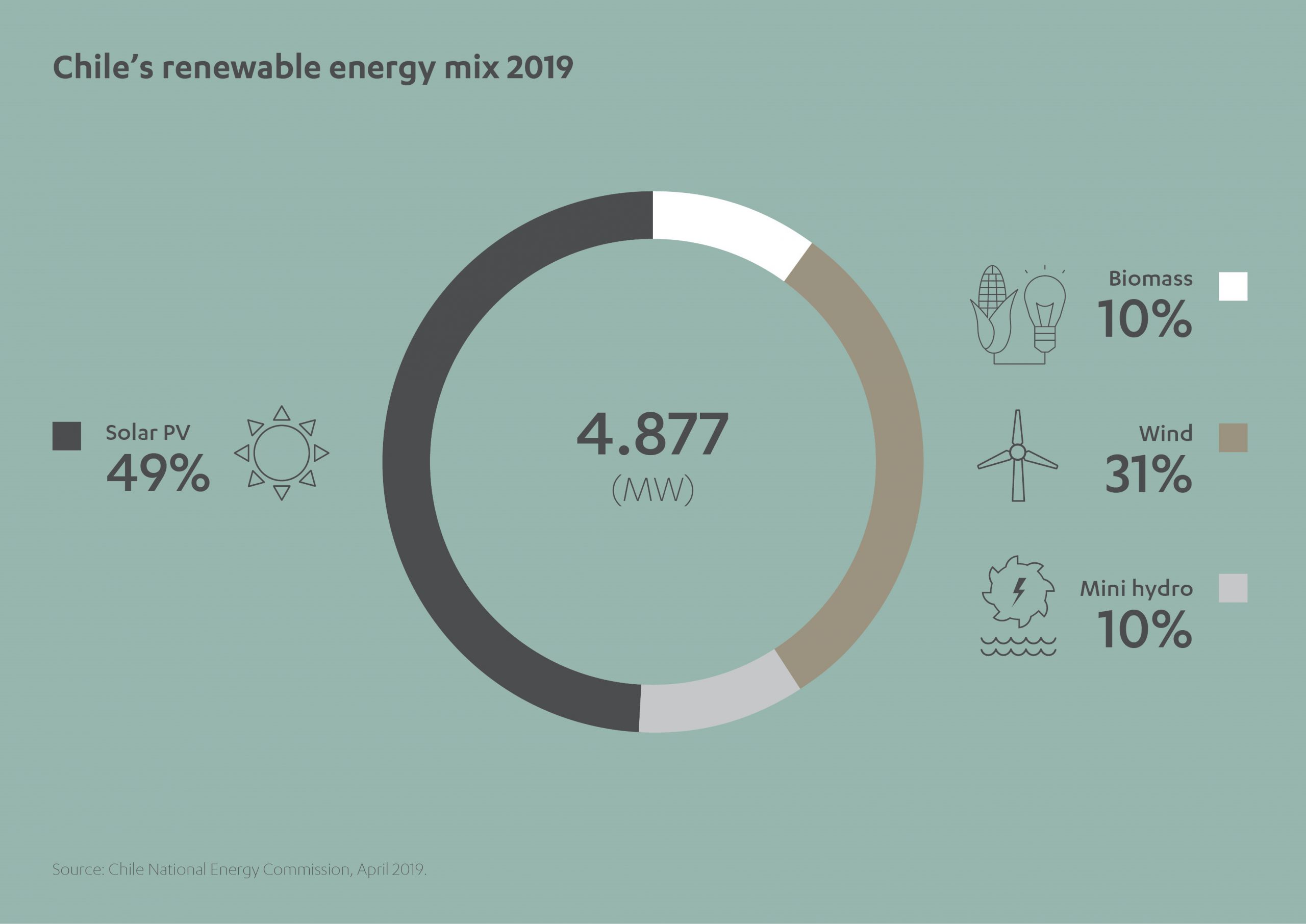

Chile is at the forefront of the renewables revolution in Latin America and can already point to a number of successful initiatives to increase the proportion of renewable sources in the country’s energy mix.

Having relied on imported coal, gas and petroleum for much of its domestic and industrial power needs since industrialization, in more recent decades this mountainous country has become a major producer of hydropower.

Environmental concerns, however, means that public opinion over the past decade – and to a certain extent government policy – have switched the renewables focus towards solar and wind energy, resources the country has in even greater abundance. The intensity of the sun in the Atacama Desert in the north of Chile, for example, is unequalled anywhere in the world. While the long coastline of Chile provides rich wind resources all year round.

Chile was producing 865 gigawatt hours of renewable electricity per month in mid-2016. By March 2019, this had leapt to 1,188 gigawatt hours[1]. By the end of September 2019, almost 22% of the nation’s total energy capacity derived from renewable energy sources[2].

Renewable energy specialist Fotowatio Renewable Ventures (FRV), part of Abdul Latif Jameel Energy, has established itself as key player in the Chilean renewables sector.

Manuel Pavon, FRV Managing Director for South America, says the Chilean government is strongly committed to further growth in the country’s renewable energy capacity.

“The government set a goal to have 20% of renewables by 2025. That goal was accomplished early, during 2018, and the government is thinking of increasing the goal to 25% or 30%. It wants to decommission all the coal-based power plants in the country – that’s five gigawatts of thermal generation – by 2040. These decommissioned power stations will be replaced by a mix of renewables and other technologies.”

One of these new developments is a hybrid solar-wind project currently being developed by FRV to power almost 250,000 homes with clean energy, all year round, split between two sites – a solar power plant in the north of the country and a wind plant in the south.

“This hybrid combination of solar and wind allows us to provide renewable energy 24/7,” says Pavon. “During the day we provide solar power, and during the night we will provide wind power. There is due to be a tender in May 2020, in which the Chilean National Commission will procure six terawatts of energy. The ‘big four’ incumbents are losing market share every year, but the market itself is growing. We expect it will continue increasing up to 1.5 gigawatts per year for the following five years. So, it is a very interesting market for us.”

In fact, such is the potential of Chile, that FRV recently relocated its regional headquarters to the country from Brazil.

“The government is very pro-renewables and there are some excellent opportunities here. We wanted to be as close as possible to this market so we can take advantage of those opportunities when they arise,” says Pavon.

It is not only the government who recognize the need for more renewable energy. Pavon says that there is a strong connection between climate change and the need for renewable energy in the minds of the Chilean public, too.

Chile is more than 4,000 km long, with a variety of climates, but rainfall is generally low and the country is in the midst of a 13-year drought. Combined with the poor perception of hydropower, it is not surprising, says Pavon, that Chile’s early adoption of renewables, and the accompanying renewable-friendly regulatory framework, means that, alongside Brazil, it has the potential to become one of the continent’s renewables success stories.

“Within the Latin American region, most countries are at a similar stage, and FRV is exploring projects in Uruguay, Brazil, Peru and Colombia. But Chile has gone one step further, in terms of things like the regulatory frameworks, for example. It can sometimes take a long time to get projects started, but it is very stable and secure. That’s why also most banks in Latin America are based in Chile,” he says.

Investing in water

The drought in Chile has highlighted the urgent need to investment in another vital part of the infrastructure of life: water.

According to information from the Meteorological Directorate of Chile, just 82mm of rainfall has been recorded in Santiago since the start of 2019. The situation is even more concerning in the Valparaíso region in the center of the country, where it is now the driest 12-month period in the region for a century.[1]

While this lack of precipitation has obvious negative effects on the country’s agricultural sector, it also has implications for Chile’s power supplies – with around 50% of the country’s electricity generated by hydropower[2] – and its mining operations, which also require large amounts of fresh water.

Large-scale seawater desalination programs could provide an answer to the country’s problems. As of December 2019, 11 desalination plants are already operating in Chile, with another 10 projects under development[3], including the largest desalination plant in Latin America, currently under construction in the Atacama region[4]. Much of the output from these plants, however, is directed towards the country’s water-hungry mining sector.

In line with Chile’s efforts to address its on-going water challenges, Almar Water Solutions, part of Abdul Latif Jameel Energy and a leading global developer of water infrastructure projects, acquired the Chilean water treatment company Osmoflo SpA in November 2019.

The investment incorporates several operation and maintenance contracts for the industrial water sector, along with a fleet of multi-capability mobile water treatment units which provide short-term or emergency solutions to industrial clients.

This portfolio is expected to expand rapidly with the development of water infrastructure projects and the provision of operation and maintenance services for a broad range of industrial sector clients seeking to outsource this requirement.

Speaking at the COP25 climate change summit in November 2019, Carlos Cosín, CEO of Almar Water Solutions and current President of the International Desalination Association, said:

“Climate change is here to stay. As leaders in the water sector, we must be aware of it and work to minimize its impact. Water is a key pillar to fight against climate change and we have a responsibility to lead new practices and solutions that can help to alleviate water scarcity and contamination across the globe.

Through innovation, and looking to new, non-conventional water resources, we can generate more effective treatments for a cleaner water supply, improved access to water in areas where it is scarce, and ultimately support in building a more sustainable future.”

Action across the Andes

Across the Andes from Chile, the renewable energy markets in Brazil and Uruguay are also benefitting for Abdul Latif Jameel Energy’s growing presence in Latin America.

One of its first projects in the region was the La Jacinta solar power plant in Salto, in the north of Uruguay, developed by FRV. This was the first solar Power Purchase Agreement (PPA) that FRV signed with the Uruguayan state-owned electric company Administración Nacional de Usinas y Transmisiones Eléctricas (UTE) and was the first to become operational, in 2015. It remains one of the largest solar plants in Latin America.

With 65 MWdc of installed power, the solar plant provides the 100% of its energy to UTE and meets the electrical needs of approximately 34,000 homes, while eliminating approximately 72,000 tons of CO2 emissions per year.

FRV sold La Jacinta to Invenergy in 2017, but Pavon says the company is currently pursuing a number of other ventures in the country:

“We have an interesting pipeline in Uruguay. We are continually speaking with UTE, which is responsible for generation, distribution and transmission, and we are aware of several potential opportunities coming up in the near future. Brazil is one of the biggest economies in the region, and we are waiting to see how the sector performs. We may have to wait a few years before we invest capital, but for the moment, we will be keeping a close eye on forthcoming opportunities.”

Making things happen in Mexico

As well as its operations in Chile, Uruguay and Brazil, FRV is rapidly establishing itself at the opposite end of the continent, in Mexico, where it has two major solar photovoltaic developments.

Its Potosi solar plant, in San Luis de Potosi, began operations earlier this year. It will generate 815,000 MWh annually, provide enough energy to supply more than 76,000 homes and reduce Mexico’s CO2 emissions by almost 98 million tons per year.

FRV’s second plant, the Potrero PV plant in Jalisco, will generate 750,000 MWh per year, supplying 128,000 homes and reducing CO2 emissions by some 437,000 tons. The Potrero plant is on course to be completed in July 2020 after around just 15 months of construction work.

Both FRV projects in Mexico are on track and performing well. “With these two projects, we’ve installed a total of 640 MW of capacity in a Mexican market currently holding around 73,000 MW. So, we have grown to become a relevant player in a very short period of time,” says Fernando Salinas Loring, Managing Director of FRV Mexico and Central America.

The first wind-power plants began operating in Mexico in 2013. The country now generates around 12.4 gigawatts from wind, compared to 2.2 gigawatts from solar. But, according to Loring, “solar is now beginning to catch up”.

One of the reasons for this success, he says, is a change in government attitude towards the renewables sector.

“The government has reaffirmed the renewable energy target of 35% by 2024, which is critically important,” he says, “Currently, 24% of Mexico’s energy is provided by clean energy. So, we need to get to 35% in the next five years. It’s not going to be easy, but it can be done.”

His optimism is shared by Manuel Pavon in Chile, fueled by pro-renewables government policies and changing public expectations.

“The sentiment we’re seeing across the whole Latin American region is concern about climate change. It is much greater than it was even four or five years ago. People are also thinking about the wellbeing of our communities and cities, and governments realize that something has to change in terms of energy policies. Renewable energy is a huge factor within all these considerations. At FRV, we are looking forward to capitalizing on these opportunities and helping to deliver a cleaner energy mix for Latin America’s future,” says Pavon.

[1] “Latin America pledges 70% renewable energy, surpassing EU”, Reuters, September 25, 2019

[2] Energy Monitor: Renewable energy in Latin America, ABN Amro, May 2018

[3] Renewable Energy Country Attractiveness Index, Issue 54, November 2019

[4] Energy Monitor: Renewable energy in Latin America, ABN Amro, May 2018

[5] “Investment in Renewable Energy Sources Is Booming in Latin America”, Americas Quarterly, accessed December 12, 2019

[6] Annual CO2 Emissions by Region, Global Carbon Project & Carbon Dioxide Information Analysis Center, 2019

[7] “Latin America and Caribbean Climate Week Is an Opportune Moment to Strengthen Regional Climate Action”, World Resources Institute, August 20, 2019

[8] The Social Panorama of Latin America, Economic Commission for Latin America and the Caribbean, December 2019

[9] “Renewable electricity generation in Chile from August 2016 to March 2019”, Statista, accessed December 4, 2019

[10] Figures published by the Chilean National Energy Commission, November 2019

[11] “Long-term drought parches Chile”, Nasa Earth Observatory, accessed December 11, 2019

[12] Electricity generation by fuel: Chile, International Energy Agency 2017.

[13] “Current situation and major challenges of desalination in Chile”, Desalination and Water Treatment Journal, December 2019.

[14] “Chilean environmental authority approves largest desalination plant in Latin America”, Reuters, September 27, 2018.

1x

1x

Added to press kit

Added to press kit