MENAT leads the way as world takes shine to solar PV

Bright times loom in 2019 and beyond for the solar photovoltaic (PV) power market in the Middle East, North Africa and Turkey (MENAT) region, reflecting a trend towards renewable energies that is truly global in scope.

Worldwide, the solar industry is set to expand by almost a fifth this year. And that’s after already reaching a new global milestone of 400 GW installed capacity in 2018.

As noted by global intelligence provider IHS[1], this year will be the first since 2011 that annual PV installations will grow across all six global regions: the Middle East, Europe, North America, South and Central America, Africa and Asia-Pacific. Thanks in part to falling technology costs, 90+ countries will increase their PV capacity in 2019 – with 10% of those set to expand by more than 500 megawatts each.

“This widespread growth has been aided by declining prices for PV technology, with average PV module prices falling 32%, and average PV inverter prices falling by 18%, in the past two years,” the IHS states.

All of which will help offset 2018’s slightly slower than anticipated PV growth worldwide, largely due to policy shifts favoring fossil fuels in the United States and China.

Despite these policy setbacks, however, the solar industry still benefited from US$ 140 billion of investment in 2018, giving PV unprecedented momentum. With 100 GW of new supply added, PV accounted for the single largest share of growth to the energy mix, with growing demand in potent European markets such as Italy and Spain.

According to a new global research report from renewable energy think-tank Ren21[2], PV accounted for 2.4% of global energy production in 2018 – less than fellow renewable, wind (5.5%) and hydro-power (15.8%) for now, but still a significant contributor to the 26.8% of renewable energy generated globally last year.

Some 32 countries now boast at least 1 GW of installed capacity each – motivated by the rising price of oil, and ongoing technological innovations making PV prices ever more enticing. Already, solar and wind are the cheapest forms of power generation across more than two-thirds of the world, with the remainder likely to match those figures by 2030[3]. In a further ray of sunshine for future market confidence, interest in FPV (Floating Photo-Voltaic) technology is continuing to increase in countries with dense populations and scarce land.

Where will all this take us? To a near-future global energy market barely recognizable from the market of today.

In its World Energy Outlook report released last winter, the International Energy Agency (IEA) backed solar PV to become a major force in this transformation. The report aimed to quantify the shrinking influence of traditional hydrocarbon fuels such as coal, oil and gas in the coming decades. Whereas in 2017, hydrocarbon fuels accounted for 30% of global power generation, by 2040 this is tipped to drop to as little as 8%[4]. PV is identified as the main rival, potentially comprising as much as 29% of global GW generation by 2040. Landmark moments, according to the IEA, will come when the installed capacity of PV surpasses wind by around 2025, hydropower by 2030, and finally coal in around 2040.

“The majority of this is utility-scale, although investment in distributed solar PV by households and businesses plays a strong supporting role,” the IEA report adds.

Recent and ongoing advances in battery technology will only see PV become more available, more reliable and inarguably more cost-effective.

PV proves a financial and ethical imperative

The world’s thirst for energy shows little sign of abating. In Asia alone, household electricity demand rose at a steady 3.7% annually between 2012 and 2017. Solar power is increasingly making its case as the right technology at the right time; a technology that can keep society turning, while simultaneously turning it greener.

This ethos is supported by global governments, who are increasingly concerted in their environmental protection regulations. One of the United Nations’ Sustainable Development Goals is to ensure “affordable and clean energy” for all, with a self-imposed 2030 deadline.

The UN argues that with 13% of people living without access to electricity, and 4.3 million deaths from air pollution in a given year, clean energy production should be a global priority across buildings, transport and industry. As such, the UN has vowed to encourage more international cooperation on renewable energy research projects and promote investment into these industries.

The UN’s intervention in the clean energy debate is timely. As Dr Fatih Birol, executive director of the IEA, notes: “Over 70% of global energy investments will be government-driven and as such the message is clear – the world’s energy destiny lies with decisions and policies made by governments.”

Why MENAT is on a hot streak with solar?

The falling cost of PV systems and the contrasting rising cost of oil are projected to see a surge in PV investment across the MENAT region through 2019, and beyond.

Countries late to the solar business are now setting ambitious targets, while those with solar infrastructure already in place have ramped-up their PV goals. The lure of low tariffs has triggered solar initiatives across the region (Saudi Arabia, Kuwait, Qatar, Egypt, Oman, Bahrain, Jordan, UAE, Morocco and Egypt) with regular announcements of new large-scale projects. This stretches beyond traditional utility or commercial installations: multiple countries also striving for significant rooftop installations before the year’s end[5].

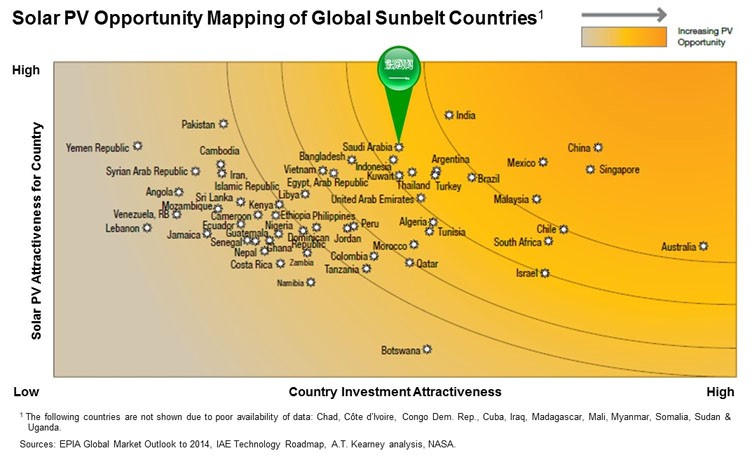

Saudi Arabia is eyed as especially fertile ground for solar growth, planning an extra 9.5 GW of green energy in the coming decade. Jordan and Egypt are likewise eager to make their mark, securing financial backing from international banks for PV projects.

Data obtained by research company Apricum demonstrates how quickly solar demand will grow across MENAT[6]. It anticipates that new PV installations will be needed equivalent to 5.5 GW (low case) to 9.1 GW (high case) of power by 2021, up from 0.8 GW as recently as 2015. This would bring MENAT’s total installed PV capacity to 32.5 GW (high case) by 2022.

While China, the United States, India and Japan are still the global solar heavyweights – together accounting for three-quarters of the world’s solar installation capacity by 2017 – the rising demand across MENAT raises the prospect of Gulf Cooperation Council (GCC) members chasing those global pace-setters.

The region does, after all, offer some practical benefits. The two cornerstones of profitable solar generation are sunshine and open space – resources the MENAT area has in abundance. Larger solar plants (often impossible in other more industrialized parts of the world) have a lower MWp cost. Labor within MENAT is often cheaper, too.

Counteracting these benefits are, inevitably, certain technological challenges particular to MENAT’s physical environment: winds, erosion, high temperatures and lack of water, all contributing to equipment and maintenance issues. Intense sunshine, while obviously vital for energy generation, can also limit the working day, with engineers and technicians often unable to operate from 10 am and 3 pm during summer months. And MENAT remains, of course, as sensitive to global economic downturns, financial investors and political unrest as anywhere else.

Yet these challenges should not distract from the overbearing evidence positioning solar power at the heart of MENAT’s green energy revolution in the coming decades. We are heading towards a world in which PV capacity could conceivably approach 1 TW by 2021. Global management consultancy McKinsey & Company is bullish indeed, predicting that PV will “continue to penetrate the global energy mix” and increase by a factor of 60 from 2015 to 2050[7].

Accordingly, MENAT’s opportunities are increasingly hard to ignore. Research consultants Wood Mackenzie predict that the 20 largest PV markets will account for 83% of new global demand up to 2023 – the fastest movers all being concentrated around the Middle East and Mediterranean (Saudi Arabia, Iran, Egypt and Italy)[8]. Bloomberg notes that SoftBank is still planning to develop a US$ 1.2 billion solar power plant in Saudi Arabia, north of Riyadh[9].

Hopes are also high in Turkey, where the government has just issued a preferential metering scheme for PV systems under 10 KW, and introduced new legislation for larger, unlicensed systems. According to Gunder’s Solar Energy Roadmap of October 2018, Turkey could reach 38 GW installed solar capacity by 2030[10]. If estimates are right, the country will install an extra 5.5 GW of PV by 2023, translating to annual growth of 1.1 GW.

FRV powers to prominence at home and abroad

It’s a compelling picture, one that drives the team at Abdul Latif Jameel Energy’s Fotowatio Renewable Ventures (FRV) to cleanly harvest power wherever the sun shines, across the Middle East, Australia, Africa, Europe and Latin America.

In April 2019, FRV began production at the Lilyvale Solar Plant in Australia, supplying power to 45,000 homes while saving 175,000 tons of CO2 annually.

Lilyvale is one of six solar projects FRV is involved with in Australia, having invested around US$ 700 million in the country’s renewable energy market since 2012. In November 2018, it signed a power purchase agreement with Snowy Hydro for the production of 67.8 MW of the Goonumbla Solar Farm project in New South Wales. When operations begin in June 2020, the plant will supply enough energy for more than 45,000 households.

Fady M. Jameel, Deputy President and Vice Chairman of Abdul Latif Jameel, said: “We are proud to be contributing to Australia’s drive for clean energy.”

In Spain, where FRV has operated for over 12 years, it recently reached financial close on a 50 MW solar farm at La Solanilla, near Trujillo, the latest in a string of solar projects across Extremadura, Andalusia, Almeria and Valladolid.

FRV is also investing its solar expertise in India, where the Andhra Pradesh plant will power 35,000 homes, and in Mexico, where the soon-to-be-operational 342 MW Potosí Solar Plant will supply more than 76,000 homes with clean energy. In a further sign of its ambitions and global reach, FRV is also actively exploring opportunities in Armenia, Chile, Jordan, Uruguay and Brazil.

Closer to home, FRV continues to explore PV opportunities across the Middle East region. The Al Safawi solar plant in Jordan began operating in April this year, the third FRV project in the country. Al Safawi, financed with a US$ 65 million loan from the European Bank for Reconstruction and Development (EBRD) and the Financing for Development Society of the Netherlands, covers 150 hectares and will supply power for 21,000 homes. FRV already has the Mafraq I and Mafraq II solar plants in Jordan – Al Safawi brings its installed PV capacity in Jordan to 200 MW.

In addition, in a sign of its determination to stay at the forefront of PV technology, FRV has this year launched a dedicated team to focus on the next generation of high-performance batteries, recognizing that power storage is critical to the realization of an electricity-orientated future.

Industry experts anticipate that any benefits from the widespread adoption of solar PV will be especially profound across the Middle East. Wim Alen, General Secretary of the Middle East Solar Industry Association, said: “The adoption of solar will lead to significant reduction in the region’s carbon footprint while saving natural gas for future or other use.”[11]

As Daniel Sagi-Vela, FRV’s CEO, explains: “As the world faces one of the biggest challenges it has ever known, we are proud to be at the heart of the battle, driving forward a new vision for the world’s energy landscape and transferring world-class skills, knowledge and best practice to the local workforce of the countries in which we develop projects.”

As Daniel Sagi-Vela, FRV’s CEO, explains: “As the world faces one of the biggest challenges it has ever known, we are proud to be at the heart of the battle, driving forward a new vision for the world’s energy landscape and transferring world-class skills, knowledge and best practice to the local workforce of the countries in which we develop projects.”

[1] https://cdn.ihs.com/www/pdf/0219/IHS-Markit-Predictions-for-the-PV-industry-2019.pdf

[2] Noteworthy Regional Trends in Power: Renewables 2019 Global Status Report – Ren21

[3] BloombergNEF.

[4] World Energy Outlook 2018, IEA.

[5] https://www.pv-magazine.com/2018/06/20/menat-to-see-massive-roll-out-of-solar-energy-in-2018-enerray-qa/

[6] https://www.businesswire.com/news/home/20170922005241/en/Intersolar-Middle-East-Global-PV-Markets-–

[7] https://www.mckinsey.com/industries/oil-and-gas/our-insights/global-energy-perspective-2019

[8] https://www.woodmac.com/news/editorial/10-trends-shaping-the-global-solar-market-in-2019

[9] https://www.bloomberg.com/news/articles/2018-11-06/softbank-said-to-plan-1-2-billion-solar-plant-in-saudi-arabia

[10] https://www.aa.com.tr/en/energy/solar/solar-comprises-60-of-turkeys-renewables-employment/21825

[11] Solar Outlook Report 2018, Middle East Solar Industry Association, March 2018.

1x

1x

Added to press kit

Added to press kit